Did you know that failing to update your LLC information could lead to compliance violations, banking issues, and even put your liability protection at risk? Many LLC owners don't realize that major business changes, such as a name update, new registered agent, or address change, require formal state filings to remain legal.

Filing an amendment doesn't have to be complicated. With the right guidance, you can keep your business compliant and avoid costly mistakes.

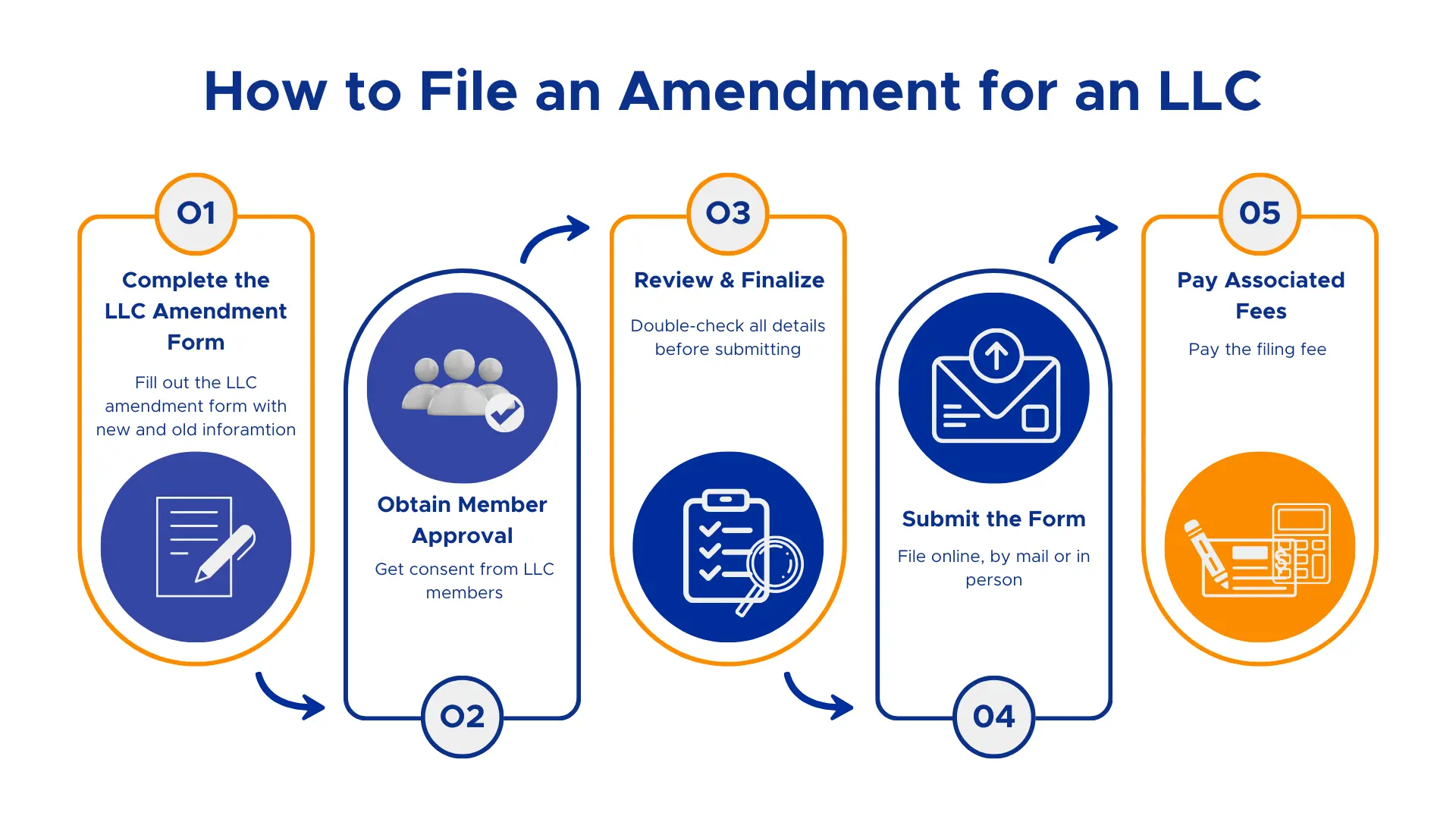

We're going to walk you through exactly when you need to file an amendment for your LLC, what forms you need, and the five essential steps to complete the process successfully. MyLLC is here to help you navigate the process with ease, from understanding requirements to submitting your paperwork.

LLC amendments are required for major changes: Name changes, registered agent updates, and address modifications must be filed with your state to maintain compliance and legal protection.

Two types of amendments exist: Articles of Organization amendments update public records with the state, while Operating Agreement amendments handle internal changes among members.

The five-step filing process is straightforward: Complete the form, obtain member approval, review for accuracy, submit it to the state, and pay the required fees, which typically range from $20 to $150.

Failure to file can be costly: According to Forbes Advisor, "Failing to update your business information with the appropriate agencies can lead to compliance problems, banking issues, and confusion with customers."

Professional help saves time and prevents errors: Services like MyLLC handle the paperwork, ensure accuracy, and guarantee timely filing so you can focus on running your business.

Your LLC isn't static; as your business evolves, so do your official records. Understanding when you need to file an amendment versus when a simple internal update is sufficient can save you time, money, and compliance hassles.

An LLC amendment is a formal document that updates your business's official records with the state. Think of it as the legal way to announce significant changes to your company's structure or identity.

These amendments modify your Articles of Organization, the original formation document you filed when creating your LLC. Once filed and approved, your updated information becomes part of your official state record and is accessible through public business searches.

According to the Small Business Administration, "For most small businesses, registering your business is as simple as registering your business name with state and local governments." However, when those registered details change, you'll need to file an amendment to keep everything current.

Most LLC owners file amendments for one of these major business changes:

Rebranding your business? A name change requires more than updating your website and business cards. You'll need to file an LLC name change amendment with your state and notify the IRS.

The IRS requires you to "Write to us at the address where you filed your return, informing the Internal Revenue Service (IRS) of the name change" to ensure tax records match your new legal name. This prevents filing issues and potential tax complications down the road.

Real-world example: Sarah's marketing LLC grew beyond local services. When she expanded nationally, "Sarah's Madison Marketing" no longer fit. Filing an amendment to "Elevate Digital Marketing LLC" required state filing plus IRS notification, but gave her business the professional identity needed for nationwide growth.

Your registered agent is your LLC's official point of contact for legal documents and state correspondence. When you need to change your registered agent, whether you are switching to a professional service, replacing a departing member, or updating information after a move, you must file an amendment.

Most states provide a specific registered agent change form, making this one of the simpler amendments to file. However, skipping this update means legal notices and compliance documents could go to the wrong address, potentially causing you to miss critical deadlines.

Moving your business location typically requires filing an amendment, though requirements vary by state. Some states require amendments for any address change, while others only require updates for your principal office address.

The key distinction: if your registered agent's address changes, that always requires filing. If only your principal business address changes, check your state's specific requirements to determine if an amendment is necessary.

Successful amendment filing starts with proper preparation. Gathering the right documents and understanding which type of amendment you need prevents delays, rejections, and the frustration of having to refile.

Before you start filling out forms, collect these essential documents:

Your original Articles of Organization

Current Operating Agreement (if amending internal procedures)

Written consent from LLC members approving the change

Your LLC's Employer Identification Number (EIN)

State filing fee (varies by state, typically $20-$150)

Having these documents ready streamlines the filing process and ensures you can complete the amendment form accurately the first time.

Not all LLC changes require the same filing approach. Understanding the difference between Articles of Organization amendments and Operating Agreement amendments determines which forms you need and where to file them.

Articles of Organization amendments change your LLC's public record with the state. These modifications require official state filing and typically include:

Business name changes

Principal office address updates

Registered agent or registered office changes

Business purpose modifications

Management structure changes (member-managed to manager-managed)

These amendments typically require filing an LLC amendment form with your Secretary of State, paying the associated fee, and waiting for state approval before the changes become official.

Operating Agreement amendments handle internal LLC changes that don't affect your public state record. These modifications don't require state filing but should be documented and signed by all members:

Adding or removing LLC members

Changing profit and loss distribution percentages

Modifying voting rights or member responsibilities

Updating member capital contribution requirements

Changing dissolution procedures

While these changes don't require state filing, documenting them properly protects all members and prevents future disputes about ownership percentages, decision-making authority, or profit distribution.

The amendment filing process follows a straightforward sequence. Each step builds on the previous one, ensuring your changes are properly documented, approved, and legally filed. Let's walk through exactly how to file an amendment for an LLC.

Start by obtaining your state's official LLC amendment form through their Secretary of State website. When completing the form, provide your LLC's current legal name, file number, the specific article being amended, and both the old and new information.

Accuracy matters. Even small errors in your LLC's legal name or file number can cause rejection and delay processing. Double-check every entry against your original Articles of Organization before submitting.

Before filing any amendment, you need formal approval from your LLC members. This is not just good practice, as many states also require documentation proving member consent before they will accept amendment filings.

The approval process depends on your Operating Agreement. Some LLCs require unanimous consent for major changes, while others allow majority vote. Review your agreement's amendment provisions to determine the required approval threshold.

Document member approval through:

Written consent signed by all approving members

Minutes from a formal member meeting where the vote occurred

Signed resolutions authorizing the specific changes

Keep these approval documents with your LLC records. While most states don't require submitting them with your amendment, you may need to provide proof of authorization if questions arise.

Before submitting, thoroughly review your completed amendment form. Verify your LLC's current legal name matches state records, the file number is accurate, all required sections are complete, signatures are in place, and contact information is current.

Having a second person review the form often catches errors you missed. Fresh eyes spot inconsistencies or missing information that seemed obvious during completion.

Once your form is complete and approved, it's time to officially file your amendment. This stage transforms your internal business changes into legal updates recognized by your state government.

Most states offer online, mail, or in-person filing. Online filing is fastest (3-5 business days), while mail takes 2-4 weeks. Many states offer expedited processing for $50-$100, reducing turnaround to 24-48 hours.

When mailing, use certified mail with return receipt requested for proof of submission and delivery confirmation.

Amendment filing fees typically range from $20 to $150, varying by state. Payment options include credit/debit cards for online filing, checks or money orders for mail filing, and cash for in-person filing when available.

Make checks payable to your state's business filing office, usually the Secretary of State. Include your LLC's name and file number on the check so it is properly credited.

After submitting your amendment, the state will review your filing. If it is approved, you will receive a filed copy, either as a stamped document, certificate, or electronic confirmation. Keep this with your formation documents as official proof that your changes are legally recognized.

If rejected, the state will explain the issues, usually missing information or incorrect fees. Once you receive confirmation, update related business accounts and licenses, and inform clients or vendors of any changes.

Filing an amendment for your LLC protects your business's legal standing and maintains compliance. When you change your LLC name, update your registered agent, or modify other critical details, proper amendment filing keeps you legally compliant.

The five-step process of completing the form, obtaining member approval, reviewing for accuracy, submitting it to the state, and paying fees gives you a clear roadmap. Remember to file amendments promptly after making changes to avoid the compliance problems.

If navigating state requirements feels overwhelming, MyLLC's experienced team handles amendment filings from start to finish. We handle the paperwork with accuracy and attention to detail, filing promptly and in line with state guidelines so you can keep your focus on running your business. Ready to file your LLC amendment? Contact MyLLC today to get started with professional amendment filing services.

Processing times vary by state and filing method. Online filings typically process in 3-5 business days, while mail submissions take 2-4 weeks. Many states offer expedited processing for an additional fee, reducing turnaround to 24-48 hours. Check your state's current processing times before filing, as seasonal volume can affect speeds.

Failing to file required amendments creates serious problems. Your state may impose penalties or fines for noncompliance. Banks might refuse to update accounts if your business name doesn't match state records. Legal documents and contracts could become invalid or unenforceable. Most critically, operating with outdated official information could jeopardize your LLC's liability protection, potentially exposing your personal assets to business risks.

Yes, name changes require more than just the state amendment. You must notify the IRS of your name change by writing to the address where you filed your tax return. Update your EIN documentation, business licenses, and permits to reflect the new name. Inform your bank to update account records. Notify clients, vendors, and business partners of the change. Update all marketing materials, contracts, and online presence. This comprehensive approach prevents confusion and ensures all official records align with your new business name.

Changing your registered agent requires filing a specific form with your state, sometimes called a "Change of Registered Agent" or a similar title. The process is straightforward: complete the form with your new agent's information, obtain signatures from both the LLC and the new agent accepting the role, and file with your Secretary of State along with the required fee. Most states process these changes quickly since they're common updates.

Most states allow you to file multiple amendments using a single form, which saves time and reduces filing fees. For example, you can change your business name, principal office address, and registered agent all on one certificate of amendment. However, some states require separate forms for certain changes, particularly when amending different sections of your articles of organization. Check your state's specific requirements to determine whether you need a single form or multiple filings for your particular changes.

Articles of amendment modify specific provisions in your original formation documents, showing only what changed. Restated articles of organization replace your entire original document with a new, consolidated version that incorporates all previous amendments into one complete document. Restated articles are useful when you've filed multiple amendments over time and want a clean, current version of your complete articles of organization as a single public record. Most LLCs only need standard amendments unless they've made numerous changes and want to consolidate their formation documents for clarity.