When Jennifer and Mark launched their consulting LLC, they skipped creating an Operating Agreement to save time. Two years later, when Jennifer wanted to leave the business, chaos erupted. Mark claimed they'd verbally agreed to equal ownership despite Jennifer contributing 70% of the startup capital. Without a written Operating Agreement, they had no proof of their actual arrangement. What started as a simple business exit turned into a $50,000 legal battle that destroyed their friendship and nearly bankrupted the company.

This scenario plays out more often than you'd think. Most new LLC owners breeze through formation paperwork, file their Articles of Organization, and think they're done. Then reality hits: a partner dispute erupts, a bank demands additional documentation, or the IRS starts asking questions. Suddenly, the absence of an Operating Agreement becomes a costly problem.

The truth is, an LLC Operating Agreement is one of the smartest moves you can make for your limited liability company. In this article, we'll discuss exactly why this document matters, what typically happens without it, and how to create one that protects your business.

An LLC Operating Agreement defines how your business operates. This internal document establishes ownership percentages, management structure, and decision-making processes that keep your limited liability company running smoothly.

Without an Operating Agreement, state default rules control your business. Your state's default provisions take over, which may not align with your intentions and can create unnecessary complications for LLC members.

Operating Agreements provide crucial legal protection. They reinforce the separation between you and your business, helping maintain the limited liability protection that made you form an LLC in the first place.

Both single-member LLCs and multi-member LLCs benefit. Even if you're the sole member, this document proves your LLC is a legitimate separate entity and protects you during audits or legal challenges.

Think of an LLC Operating Agreement as your limited liability company's instruction manual. It's an internal document that spells out exactly how your business operates, who owns what, and what happens when things don't go according to plan.

Unlike your Articles of Organization, which you file with the state to create your LLC, an Operating Agreement is one of the most important documents you keep on hand. It doesn't get submitted to the government, but that doesn't make it any less important for business owners.

A well-drafted Operating Agreement gives you control over your own rules instead of letting generic state law dictate how your limited liability company functions. You decide how profit distribution works, how major decisions get made, and what happens if a member wants to leave.

According to the U.S. Chamber of Commerce, "Operating agreements serve as the rulebook for your LLC. They protect members from liability, outline how profits and losses are shared, and help avoid confusion about who controls what within the business."

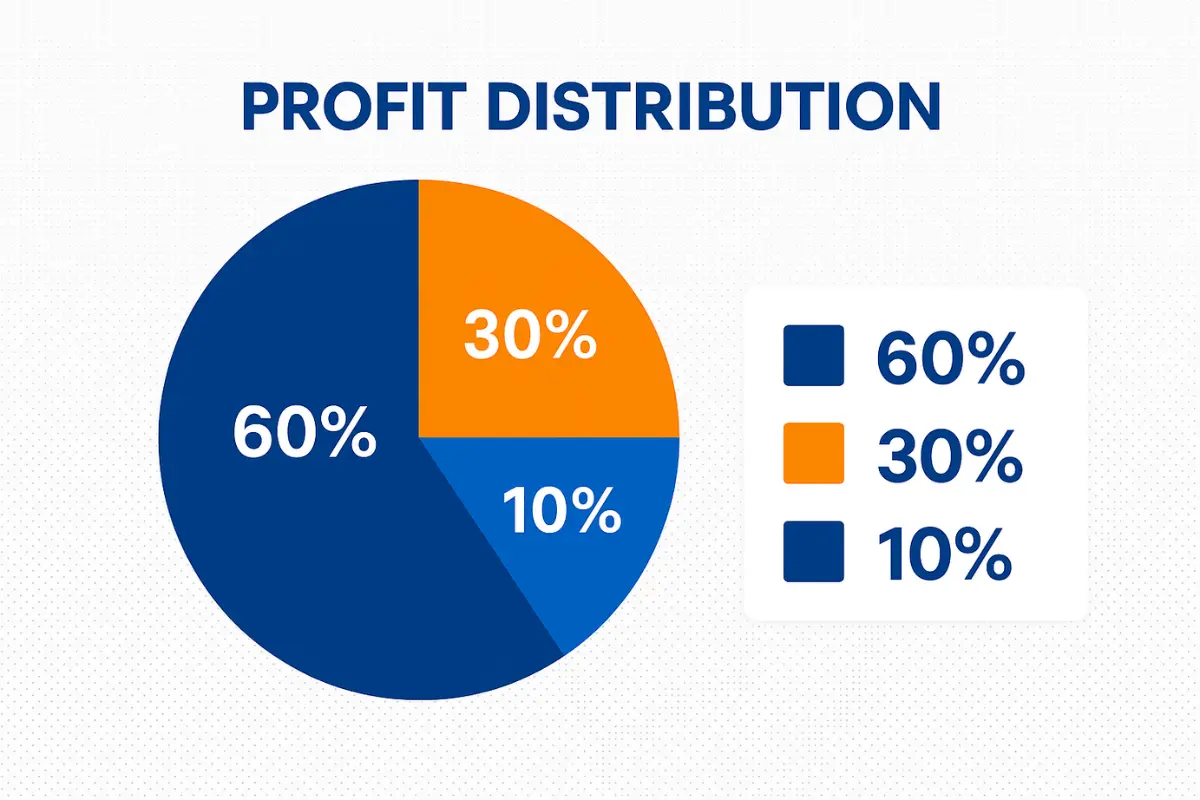

Real-world example: Two business partners, Marcus and Jessica, started a digital marketing LLC together. They split ownership interests 60-40 to reflect Marcus's larger initial capital contributions. Without a written Operating Agreement specifying this arrangement, their state's default rules would have assumed equal 50-50 ownership percentage regardless of who contributed more capital.

Most states don't actually require Operating Agreements. Only a handful of states mandate them as a legal requirement.

States that legally require Operating Agreements:

California

Delaware

Maine

Missouri

New York

But here's what matters more: you should get an Operating Agreement for your LLC regardless of whether states require it.

Why? Because without your own Operating Agreement, your state's default rules automatically apply to your business. These default provisions were written to cover every possible LLC scenario, which means they probably don't fit your specific situation. State law provides basic governing principles, but they may not align with what you and other members actually want for your business structure.

As NerdWallet explains, "Even if your state doesn't require it, an LLC operating agreement is essential. It reinforces your limited liability protection, provides clarity for owners, and overrides default state laws that govern your business by default."

Real-world example: Sarah formed a single-member LLC in Texas. When she applied for a business loan, the bank requested her LLC Operating Agreement. Without one, her loan approval got delayed by weeks.

Let’s explore why an LLC Operating Agreement is more than a formality—it’s an essential foundation for protecting your company and clarifying how it operates.

Your LLC was designed to limit personal liability for business debts and obligations, but that protection isn’t automatic. To preserve your limited liability status, you must demonstrate that your business operates as a distinct legal entity.

A written Operating Agreement is one of the key documents that show separation between you and your LLC. If your records, finances, or governance appear blurred with your personal affairs—and no formal agreement exists—a court could “pierce the corporate veil,” making you personally responsible for company debts.

Thomson Reuters notes that an operating agreement helps protect members from liability, reinforces the LLC’s status as a separate legal entity, and clarifies how the company is managed and operated.

An Operating Agreement defines how key business decisions are made—who has authority, what requires a vote, and how conflicts are managed.

Without this framework, your LLC defaults to state laws, which often demand unanimous member consent for major actions. That can lead to gridlock and misunderstanding, especially in multi-member businesses. Putting specific decision-making processes in writing ensures clarity and prevents disputes before they arise.

Money and ownership can create friction among business partners if expectations aren’t aligned. State default rules typically divide profits and losses equally among members, regardless of their financial or operational contributions.

Your Operating Agreement lets you override these default laws by clearly defining each member’s ownership percentage, capital contributions, voting rights, and distribution plan. This ensures profits and control are allocated according to real investment or involvement.

Most banks require a signed LLC Operating Agreement before they will open a business checking account. It verifies your company’s structure, ownership, and authority to act. Financial institutions generally reject generic templates—they expect a custom agreement that matches your LLC’s formation documents.

Having a professionally prepared agreement not only meets banking requirements but also signals organizational credibility and thoroughness.

Disagreements, member withdrawals, or ownership changes are inevitable in business. Your Operating Agreement should outline what happens in these scenarios—how members can leave, how their interests are valued, and how disputes are resolved.

Including clear buyout, mediation, and dissolution procedures helps you manage conflict constructively while keeping the business operational.

Do I need an Operating Agreement for my LLC if I'm the only owner?

While most states do not legally require single-member LLCs to have an Operating Agreement, creating one is highly recommended for several practical and legal reasons.

Here's why single-member LLCs absolutely need an LLC Operating Agreement:

IRS scrutiny: Even though the IRS treats single-member LLCs as “disregarded entities” for tax purposes, a written Operating Agreement helps demonstrate that your LLC is a legitimate, separate business entity. This distinction supports the integrity of your limited liability protection.

Legal protection: Courts are more likely to “pierce the corporate veil” if a single-member LLC operates without formal documentation like an Operating Agreement. This document helps prove that your business is distinct from you personally.

Banking relationships: Many banks and lenders require an Operating Agreement before allowing you to open a business account or secure financing.

Future growth: Even if you are the only member now, a properly drafted Operating Agreement makes it easier to add new partners or investors in the future, since it outlines procedures for membership changes and capital contributions.

Estate planning: An Operating Agreement can include provisions for what happens to your business if you pass away or become incapacitated, ensuring smoother transitions and clearer succession planning.

In summary, while not mandated in most jurisdictions, having an Operating Agreement strengthens your LLC’s credibility, supports liability protection, facilitates banking relationships, and ensures smoother succession and future business flexibility.

If your LLC has more than one owner, an Operating Agreement is absolutely critical. Multi-member LLCs face unique challenges that make a well-drafted Operating Agreement essential.

Your LLC Operating Agreement should clearly document each member's ownership percentage, initial capital contributions, and how future contributions affect ownership interests among LLC members.

Will all members participate in daily management (member-managed LLC), or will you appoint managers (manager-managed LLC)? These questions about members' rights and voting rights need clear answers.

Profit distribution doesn't have to follow ownership percentage. Your LLC Operating Agreement can accommodate different preferences for your multi-member LLC.

What happens if one member wants to sell their ownership interests? Buy-sell provisions in your Operating Agreement help manage financial obligations when members exit.

Articles of Organization are your LLC's birth certificate. You file this legal document with your state to legally create your limited liability company. It contains basic information like your business name, registered agent, and business address.

LLC Operating Agreements are your internal rules. You don't file this internal document with the state—you keep it with your business records.

Think of it this way: Articles of Organization tell the state your LLC exists. Your Operating Agreement for your LLC tells your limited liability company how to function.

A comprehensive LLC Operating Agreement typically includes basic information and these key sections:

Company information: Your LLC's legal name, formation date, principal business address, and registered agent details.

Member information: Names, addresses, ownership percentage for each member, and initial capital contributions.

Management structure: Whether your LLC is member-managed or manager-managed.

Voting procedures: What decisions require member votes and voting rights.

Profit distribution: How and when profits get distributed among LLC members.

Transfer provisions: Restrictions on transferring ownership interests to new members.

Buy-sell provisions: Valuation methods and payment terms for buyouts.

Dissolution procedures: Circumstances that trigger dissolution and asset distribution.

Creating an LLC Operating Agreement doesn't have to be overwhelming. Here's a step-by-step approach:

Step 1: Gather essential information. You'll need your LLC's legal name, member information, ownership percentage, and documentation of capital contributions.

Step 2: Decide on key terms. Have conversations with business partners about profit distribution, decision-making authority, voting rights, and exit strategies.

Step 3: Choose your creation method. You can hire an attorney, use a professional LLC service for an LLC Operating Agreement template with customization, or attempt DIY with a basic Operating Agreement template.

Step 4: Draft and review. Make sure every section addresses your specific needs. Every LLC member should read and understand the complete agreement before signing.

Step 5: Implement and maintain. Keep the original with your important documents and review it annually or whenever significant changes occur in your business structure.

A basic LLC Operating Agreement template gives you a starting point, but generic templates aren't complete solutions for your limited liability company. Customize your agreement to reflect your actual ownership structure.

Many Operating Agreements skip crucial situations like dispute resolution or dissolution triggers. Planning for problems while everyone gets along is infinitely easier.

Your business changes. Your LLC Operating Agreement should change with it. An outdated agreement creates confusion about which rules apply to LLC members.

Some states have specific legal requirements about what LLC Operating Agreements must include. Work with professionals who understand state law.

Absolutely. While it's best to create your LLC Operating Agreement during formation of your limited liability company, you can draft one at any time. If you already have a new business but no written Operating Agreement, make creating one your immediate priority.

Generally, no. LLC Operating Agreements don't require notarization to be legally valid in most states. However, some banks may request a notarized agreement.

The cost depends on how you create it. Using a free LLC Operating Agreement template from MyLLC means there’s no cost at all. If you choose to have a professional service customize your agreement, prices typically range from $200 to $500. Having an attorney draft one from scratch can cost between $500 and $2,000 or more. Investing in expert guidance can help you avoid costly legal issues in the future.

Without your own Operating Agreement, your state's default provisions automatically govern your limited liability company. You'll face practical problems with banks, the IRS, and potential lawsuits. Most importantly, you lose control over operating procedures and how your business operates.

Yes, and you should modify it whenever your business circumstances change significantly. Common reasons include adding new members, changing ownership percentage, or switching from member-managed to manager-managed structure.

You now understand why business owners need an Operating Agreement. Here's your action plan:

Assess your current situation. If you don't have a written Operating Agreement for your LLC, make creating it your immediate priority—whether you have a single-member LLC or multi-member LLC.

Gather necessary information. Collect details about your limited liability company structure, LLC members, ownership interests, and operational preferences.

Get expert guidance. Working with experienced professionals ensures your legal documents actually protect your limited liability status and comply with state law.

Implement and maintain. Keep your LLC Operating Agreement with your important documents and commit to reviewing it annually.

Don't wait until a dispute arises among business partners or the IRS starts asking questions. Protect your limited liability company now with a comprehensive agreement.

Your limited liability company deserves a solid Operating Agreement that protects your interests and clarifies how your business runs. This critical legal document helps deliver the protection, structure, and professional credibility your LLC needs to succeed.

A well-crafted Operating Agreement elevates your business from a simple legal entity into a properly structured organization with defined guidelines and processes. It safeguards your limited liability protection, prevents expensive member conflicts, and builds trust with financial institutions and potential investors.

Our team specializes in LLC formation and helps you create an Operating Agreement tailored to your business needs. Haven’t registered your LLC yet? We can take care of the entire formation process for you. MyLLC also offers registered agent services and ongoing compliance support to help you keep your company in good standing with state agencies.

Ready to protect your business? Contact us today and let's build the strong foundation your limited liability company needs to thrive.